by Jeff Mackler, published on Socialist Action, December 4, 2022

“What is the robbing of a bank to the founding of a bank?”

—Bertolt Brecht, The Threepenny Opera

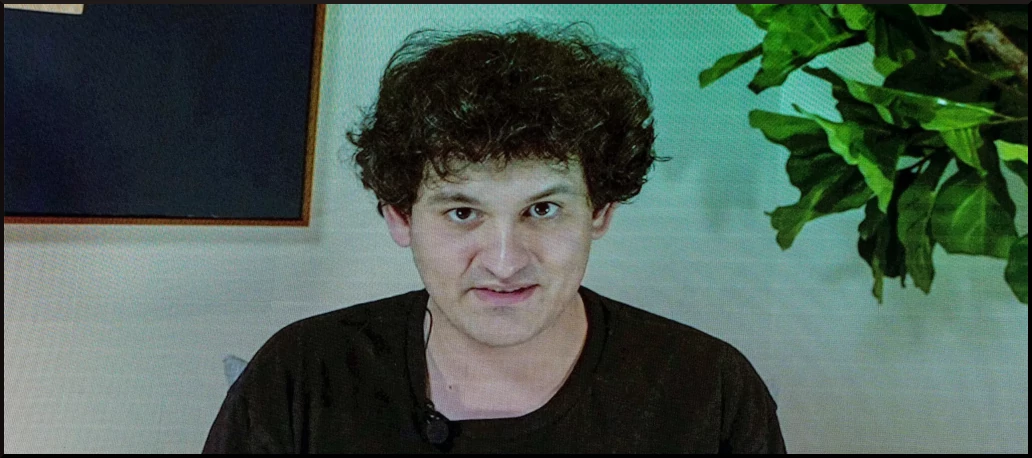

Thirty-year-old “wonder boy” Sam Bankman-Fried (often called SBF) was, at $21 billion, among the richest men on earth. Until a month ago, he was CEO of the second-largest cryptocurrency exchange in the world, FTX—valued at $32 billion. On the cover of Forbes and Fortune magazines, he was touted as a financial genius akin to Berkshire Hathaway’s billionaire financier, industrial magnate, and “philanthropist” Warren Buffett. But SBF’s FTX filed for bankruptcy in early November. A competitor, CoinDesk, apparently hacked its financial balance sheet and made it public, revealing grave discrepancies between FTX’s claimed worth and the reality of its investment portfolio. All hell broke lose as investors ran for the hills. In a matter of days most of FTX’s $32 billion evaporated.

The bankruptcy court’s appointed trustee, John J. Ray, whose experience included supervision at some of the highest-profile bankruptcies, including the oil behemoth, Enron, stated that he has never seen anything as bad as FTX.

To date, according to the publication Market Watch, Ray’s bankruptcy team has recovered about $1.2 billion in cash and some $740 million in assorted cryptocurrency. The great majority of FTX’s previously claimed $32 billion “hasn’t been found” according to Ray.”

Market Watch reported that FTX owes its 50 largest creditors $3.1 billion. The firm’s lawyers estimate there may be more than 1 million creditors, a number of which became near-instant millionaires with FTX’s meteoric rise. No doubt, others have been reduced to their pre-speculative largely middle-class status. The Ontario Teachers’ Pension Plan reported that it was writing down a $95 million investment in FTX, a tragic indication that crypto speculation has cut into the resources of some working class organizations.

Market Watch explained that “Other financial oddities remain. SBF himself cashed out $300 million of a $420 million funding round. More than $370 million appears to be missing in a possible hack which occurred after the bankruptcy filing.” FTX attorneys told bankruptcy officials that a substantial amount of the company’s assets had either been stolen or missing, casting doubt on the odds of recovering billions of dollars in crypto that customers lost.

According to Ray and other “experts,” SBF might go to jail. Or, in the alternative, he may be deemed a bad businessman and set free to embark on new forms of speculative capitalism.

“That’s the million-dollar question,” said Joe Rotunda, director of the enforcement division of the Texas State Securities Board, which has been investigating FTX since before its collapse. Indeed, it might be a multi-billion-dollar question.

“Bad investments don’t necessarily mean prison. The big one is fraud. That’s the big hammer,” according to Rotunda. “Concealing or lying. Words and conduct. There’s a duty to truthfully disclose,” he explained. “Truthful disclosure,” in this writer’s view is an oxymoron if there ever was one.

From hero to villain

SBF was no ordinary billionaire. He was the second-largest contributor to the Democratic Party’s 2022 mid-term election campaign. Even-handedly, however, an FTX associate contributed a similar amount to the Republicans. Indeed, SBF all but pledged to contribute $1 billion to the Democrats by 2024. All told, their reported mid-term generosity to the twin capitalist parties totaled $72 million, no doubt to influence legislation that buttressed FTX’s complex blockchain operations – massive and connected lines of code – that largely shielded FTX’s millions of investors from taxation or other government interference. The New York Times Magazine staff writer David Wallace-Wells called blockchain “the basis for a realm of pure and unregulated speculation.” (Sunday, November 27, 2022)

Cryptocurrency has been largely unregulated; it was only in the IRS’s 2022 tax forms that an item appeared regarding reporting cryptocurrency income. FTX itself was headquartered in the Bahamas, a tax haven Mecca for the superrich whose accountants, inside and outside the US, participate in writing and rewriting the thousands of pages that constitute US tax law. President Biden was not far off the mark when he blurted out in the run-up to the 2020 elections that “the rich don’t pay taxes.” They still don’t!

Background to bankruptcy

Three months after FTX raised $400 million in January 2022 from major investors, including big-time hedge funds, its market valuation skyrocketed $7 billion to $32 billion. Ten months later it filed for bankruptcy. Its rival or associated crypto outfits, who regularly traded crypto coins with each other, likely to drive up the prices, have undergone massive loses over the past several months. Today they are in near free fall.

The leading crypto outfit, Binance Coin, that FTX unsuccessfully approached for aid before it collapsed, has dropped 47 percent since January 2022. Bitcoin has tumbled 64 percent; Cronos, 88 percent; TerraUSD, 98 percent and Luna 100 percent.

The crypto speculative financial craze has been fueled by the lure of super-fast and astronomical profits. Initially, its imaginary or virtual “coin” value was pegged one-for-one to the U.S. dollar. With an unprecedented mass of literally millions of online speculators betting on its rapid rise, its value dramatically soared. It quickly doubled, tripled, quadrupled and ultimately increased more than a thousand fold, minting a mass of near-instant millionaires and beyond. Its touted blockchain technology, powered by tens of thousands of computers, consumed some 0.55 percent of the world’s energy supply. It was said to be impenetrable—free from government oversight and, thus, free from tax obligations. Anonymous crypto speculators, called miners, spent countless hours pouring over new deals and opportunities. Initially, it was a dreamworld for anti-government-intervention libertarian politicos, who marveled at SBF’s gifting NGOs and related altruistic causes millions of dollars. Charity from those with means, in their view, topped compulsory government-mandated programs for the masses, like Social Security, healthcare and free education. “Generous” ruling class billionaires have been the norm in the U.S., sponsoring charitable foundations—Ford, Carnege-Mellon, Rockefeller, Bill and Melinda Gates, etc.—that serve their political ends while providing convenient tax deductions.

FTX’s TV commercials featured NBA superstar Stephen Curry, NFL legend Tom Brady and his then-wife supermodel Gisele Bündchen, tennis star Naomi Osaka, entrepreneur star of the hit TV show Shark Tank Kevin O’Leary, and “Seinfeld” creator Larry David. FTX and Bankman-Fried were as American as apple pie! Invincible!

Not really! Unlike, the multi-trillion dollar super banks—JPMorgan Chase, Bank of America, Wells Fargo, etc.—and giant hedge funds, whose CEOs and internal hierarchy really run the U.S. government, FTX and the vast array of similar cryptocurrency outfits, previously valued at $1 trillion, have suffered grave losses. They had no serious ruling class connections to bail them out when their speculative frenzy ended in disaster.

Billionaire SBF was a well-known Washington, D.C. lobbyist, championing legislation that favored his interests, testifying before various committees, and wielding influence behind the scenes with congressional staff, no doubt having opened usually closed doors via major donations to influential parties. Today, a host of previously admiring politicians have changed their tune, with a broad range of congressional committees promising to scrutinize SBF and the crypto industry more generally.

“Anything he has been pushing policy wise will be reassessed,” said Lee Reiners, a financial technology expert at Duke University Law School who was formerly at the Federal Reserve Bank of New York.

“Reassessment” promises notwithstanding, with regard to every previous financial crash on record, where billions and trillions of dollars have been ”lost” or stolen by the power elite, little or nothing has been changed in the way capitalism functions.

The Obama era’s unprecedented multi-trillion-dollar bailout

In sharp contrast to today’s crypto debacle, in 2009 then-U.S. Treasury Secretary Henry Paulson, along with Federal Reserve chair Benjamin Bernanke, following a closed-session meeting with the nation’s leading bankers, stopped by President George W. Bush’s office for a moment on the way to a special session of Congress. They had but two pieces of paper in hand, drafted a few hours earlier by the ruling class. They informed Bush on behalf of their masters that unless their unanimous two-page proposal for an instant near-trillion-dollar government bailout was approved, the entire US economy and all its associated financial markets would collapse. The hapless Bush responded, according to The New York Times, “Why didn’t anyone tell me?”

Within days, Democrats, then in control of the Congress, joined at the hip with Republicans, near unanimously approved the largest and ongoing corporate bailout in history. The initial trillion-dollar package was followed by two years of monthly “quantitative easing” allocations to the basic institutions of America’s ruling rich in the form of zero or near-zero interest-free loans that the super rich instantly invested in their casino capitalism financial system, raising stock market prices to historic highs while 10 million families lost their homes in the “sub-prime” mortgage debacle. This collapse effectively bankrupted the great financial institutions that had incredibly leveraged their assets far beyond their capacity to cover any possible defaults that might arise. And when the defaults did arrive, en masse, they were totally incapable of meeting their obligations with their own resources. They unanimously turned to “their” government for relief.

Lehman Brothers did file for bankruptcy. It was in debt to the tune of $1.2 trillion. The trillionaire banking establishment declined to assist. Lehman was thrown to the wolves and dismembered. The others, having similarly lost multiple billions, if not trillions, hastily drew up their two-page bailout legislation proposal and assigned Paulson and Bernanke to deliver their verdict. Soon after, the government orchestrated the unprecedented printing of various forms of paper money, bonds, etc. to be used to pay off the bankers’ debts. Those who had lost homes and jobs received little or nothing. Indeed, the Obama administration assigned the task of aiding those with underwater mortgages to the very banks and companies primarily responsible for originating the usurious mortgages – which had been packaged as derivatives and sold to investors, who thus profited from the housing bubble and its collapse. During the first three years of the Obama “recovery,” the top 1 percent captured 95 percent of the country’s income gains.

The Trump pandemic era corporate bailout

Twelve years later, when the Covid pandemic shuttered a great portion of U.S. industry and the U.S. economy and the stock market were reeling, the Trump administration, again joined by the Democrats, orchestrated an even greater ruling class bailout. Long-time observers were stunned by the magnitude of Federal Reserve’s 2020 bailout, which once again essentially gifted trillions in near-interest-free loans, available on any quality of collateral, to the U.S. elite. This credit expansion, quantitatively larger than any other rescue assistance in history, assured the major financial speculators that they would be rescued the next time around. “Too big to fail” was etched in stone as the government’s credo. This massive investment of fictitious capital, paper money in all its manifestations, that has no assured material basis in commodities or productive activity, as we shall see, is driven by the inherent contradictions in the capitalist system itself.

$2 trillion was initially allocated as part of the Covid-era pandemic bailout, an extraordinary amount, roughly equal to 10 percent of the U.S. GDP, at that time. This was seen as only the government’s first step in saving capitalism. New York Times columnist Jeff Sommar clearly explained their strategy:

“On Monday, March 23 the Fed announced that it would, essentially, take whatever actions were needed to restore stability in the markets, as well as the economy.” Referring to “quantitative easing,” which the Fed employed to combat the global financial crisis of 2007-08, Sommar said, “The new policy amounted to quantitative easing to infinity and beyond.” (NYT, March 27, Emphasis added).

Sommar continued: “The Fed’s new policies are so large, and operate on so many fronts, that they are difficult even to catalog. In addition to lowering short-term interest rates to nearly zero, the central bank will buy Treasury securities, government agency securities and corporate bonds. Beyond that, the newly-enacted [$2 trillion] fiscal stimulus package will enable the Fed to increase its already immense firepower by as much as $4 trillion.” In short, the government of, by and for the capitalist class, incorporated in its plans an additional pledge of $4 trillion, or roughly one-fifth of the nation’s annual GDP.

Said Federal Reserve chair Jerome H. Powell, “When it comes to this lending, we’re not going to run out of ammunition.” Powell was blunt. At least for now, the corporate powers, whose government they own and control, were ready to literally print money or its paper equivalent to match 100 percent of the expected quarterly U.S. GDP decline—that is, the full amount of the total value of the goods and services no longer expected to be produced by U.S. workers for U.S. capitalists.

At that time, the Labor Department’s published figures indicated that 3.28 million workers had filed for unemployment insurance in the past week, five times more than any numbers ever reported in U.S. history, and with additional millions expected to follow in the weeks and months ahead. As with Obama’s bailout, the vast majority went to the ruling elite while workers suffered. Trump, ever pointing to the stock market’s enormous gains, bragged that all was well. Meanwhile, the Labor Department’s rigged figures aside, the government’s Labor Participation Rate indicated 35 percent of all eligible workers were unemployed. Millions more worked in the part time, zero benefit, low wage, casual labor, gig economy. The fix was on with regard to stabilizing the stock market and ensuring capitalist profits. But the stage was also set for Trump’s anti-scientific Covid policies leading to the U.S. emerging with the largest number of Covid deaths in the world.

Origins of the current crises

Capitalism’s broad-ranging and mounting crises today are essentially driven by the inherent contradictions in the capitalist system itself. Long ago, Karl Marx explained this in great detail in his classic work Capital. “The law of the tendency of the rate of profit to fall,” he explained, was at the center of capitalism’s ever-recurring boom and bust economic recession/depression/recovery cycles. In the face of ongoing competition among capitalists to maintain and conquer new markets, each is forced to constantly update, modernize and automate its productive facilities, in each instance generally substituting increasingly high-tech machines for workers. The value of every commodity, Marx explained, is a measure of the quantity of human labor embodied it in the normal course of its production. Over time, the proportion of human labor power embodied in all commodities, relative to machines, diminishes. Whatever advantage one capitalist momentarily gains over his competitors by introducing updated technology, is in time negated as the weaker capitalists are forced to leave the marketplace while those remaining are compelled to merge or borrow to introduce yet another round of technological innovation. But with each successive round, the amount of embodied labor time decreases and with it the amount of profit the boss class can extract from workers. That is, the average rate of profit declines.

Capitalists are well aware of this dilemma and are compelled to fight it tooth and nail. In the financial arena, promises to invest the government’s bailout trillions in new plants that create new jobs but lower profits are disappeared, and the trillions are instead invested in the various speculative financial markets that promise instant and higher profits. This “financialization” process, the creation of “fictitious” capital, paper money, bonds, securities, etc., based not on investment in the real economy, but only on future speculative gains, increasingly dominates capitalist investment policies today. In decades past, a tiny proportion of capitalist profits was invested in bank and related financial institutions, perhaps five percent. That percentage has qualitatively expanded today.

The Concentration and Centralization of Capital and Fictitious Capital

In recent decades, the concentration and centralization of wealth has increased with a vengeance. Over half of all public corporations have disappeared over the last twenty years, either filing for bankruptcy or bought and dismembered by rivals. Between 1996 and 2016, the number of publicly listed stocks in the U.S. fell by roughly 50 percent—from more than 7,300 to fewer than 3,600. Mergers and acquisitions are the major cause for this delisting.

The result of this increased concentration, centralization and financialization is evident. From 2007 through 2016, stock repurchases (the buying back of their own shares) by 461 companies listed on the S&P 500 index totaled $4 trillion, an amount equal to 54 percent of their profits. These companies also declared $2.9 trillion in dividends, 39 percent of their profits. To finance takeovers, they increased corporate debt and used their takeover victims’ cash reserves as collateral to borrow in order to facilitate the stock purchase and finance payouts to investors while firing many of the employees of the dismembered corporations.

Thus, profits in U.S. capitalism today are rarely directed to building new plants, employing new workers and expanding output in the US, but rather, in large measure, to purchasing or repurchasing company shares, which inflates the wealth of the group at the top that overwhelmingly own corporate stock. In a real sense, the “insiders” have founded a system that, for them, guarantees their disgusting wealth, while lesser players, including FTX’s SBF and associated cryptrocurrency speculators, often go from great heights to great depths. Again, the emergence of the highly speculative cryptocurrency market is but another reflection of Marx’s inescapable “Law of the tendency of the rate of profit to fall.” British Marxist economist Michael Roberts explained it well, “Speculation is inherent in capitalism, but it increases, as other financial activities, in times of economic malaise and crises, i.e. when profitability falls in the productive sectors and capital migrates to unproductive and financial sectors where the rate of profit is higher.”

If we are correct in defining SBF’s blockchain technology as the vehicle for “pure speculation,” that is, the solicitation of millions to bet on whether the value of a non-existent “coin” will rise or fall, what can we say about the U.S. stock market and its trillionaire investors? Today’s wide swings in the Dow Jones Industrial Average, not infrequently 500 to 1,000 points in a day, inform us that there, too, speculation reigns. But not always. The big players at the top of the leading corporations, the “insiders,” buy and sell in a manner that guarantees they are winners. In every casino, the House always wins! SBF in contrast, half-jokingly stated that his crypto business is really akin to a classic Ponzi scheme.

Capitalist “solutions” in the real economy

Life in capitalist America and worldwide repeatedly informs us that there can be no “good capitalists” or good capitalist parties or capitalist politicians. All are compelled by the very system they uphold to live and function at the expense of all humanity. In the real economy, as well as in the financial sectors, the same holds true. Capitalists are compelled to counter declining average profit rates with ever-intensifying attacks on working people. Massive social cutbacks, anti-labor legislation, layoffs, part time casualization of work, forced overtime, computer surveillance-intensification of the labor process/speedup, mortgage foreclosures, cuts in fringe benefits, increased taxes on working people, decreased taxes, if any, on the rich, obliteration or cutbacks of pensions, Social Security benefits, health care coverage, public education, the imposition of multi-tier wage systems, the employment of near slave labor prisoners at an hourly average wage of 50 cents, and racist, sexist, anti-LBGTQI+, and anti-immigrant discrimination aimed at pitting worker against worker, are no accidents. If they are not seriously pursued, the errant capitalist can only fall prey to those competitors who do understand how the game must be played.

Every one of the above measures center on making workers pay for capitalism’s central and inherent contradiction. And when these heinous measures prove insufficient to stem profit declines in the U.S., the ruling elite embark on massive efforts to transfer production—through de-industrialization and off-shoring—outside their own borders to free themselves from the gains workers have won following decades of struggle. The result is the ever-increasing exploitation, super-exploitation and degradation of life across the globe, not to mention endless wars of plunder and conquest, and the catastrophic increase, not decrease, of fossil fuel production that threatens, in the short term, life on earth itself. Capitalism’s degradation of human beings knows no limits!

The system itself cannot be significantly reformed. It must be abolished. And the only force on earth capable of doing so is an independent, fighting, militant working class, democratically organized at the point of production and in the political arena in the tens of millions, and whose ranks have been infused with the ranks of a mass revolutionary socialist party aimed at building a new world free from all forms of capitalist degradation, exploitation and oppression.

Jeff Mackler is the National Secretary of Socialist Action. He can be reached at socialistaction.orgsocialistaction@lmi.net

Just looking at this guy, would you give him your money? I always saw crypto-currency as a ponzi scheme.