By John Pottinger, published on Socialist Action, March 27, 2024

Yes, this article is talking about the so-called “Entitlement” that ordinary working people pay out of their wages week in and week out. Only the low wage earners pay relative to their full wage while higher wage earners pay against a portion of their wages consistent with the wages of a low income person. When you consider the structure of our ‘democracy’ so deeply rooted in our corporate capitalist economy, you see that over the course of a couple of generations, the governing oligarchy has made significant progress in revoking the hard won economic gains of a massive uprising of workers in the US when my parents were children. They lived well and I grew up in a world of optimism while my son’s generation came of age in a time of social collapse. This isn’t just about old people. [jb]

Every now and then I go to a website called “The Motley Fool.” In addition to stock market advice they have a lot of commentary on Social Security. Last June they published an article titled “Social Security Beneficiaries Have Been Cheated Out of $6,200 in Annual Income Since 2000.”

Since Social Security is a good portion of my income I took the bait. While the article has some good points, it only scratches the surface. But the more you dig the more you find. Let me say in advance that I’m sorry how wonky the following is going to be.

In January 1995 Alan Greenspan, then Federal Reserve Chair and follower of rightwing ideologue Ayn Rand, testified to Congress that the Consumer Price Index (CPI) overestimates the cost of living by 0.5 to 1.5 percent annually. This led to the Boskin Commission headed by Michael Boskin, former chair of the Council of Economic Advisers for George H. W. Bush. Boskin was also a director of Exxon-Mobil and Oracle Corporation. Also on the Commission was Robert Gordon, Northwestern University professor, member of the Business Cycle Dating Committee of the National Bureau of Economic Research and a Democrat.

A bi-partisan den of thieves.

The Boskin Commission came up with four categories of “biases,” that is, factors that increase rates inflation where the bourgeoisie thinks they shouldn’t.

These were:

- Substitution bias, divided into lower level and upper level

- New product bias

- Quality bias, and,

- Outlet bias.

Lower level bias is when, for example, a rib eye steak jumps to $18 per pound and you decide to buy hamburger instead, both being beef. If you read bourgeois economists they often present trivial examples like the difference between Haagen-Dazs ice cream and Ben and Jerry’s. They do this because they know there will never be a March on Washington demanding Haagen-Dazs.

So the up shot here is that the steep rise in the price of rib eye is not so inflationary after all, because you bought the hamburger instead. In this spurious view, prices go up but inflation does not!

But if that’s not enough they take the price of the rib eye, the hamburger and other cuts of beef and apply the geometric mean instead of the arithmetic average to calculate the CPI.

Most people know that the arithmetic mean is just the “average,” that is, 2 plus 3 plus 4 = 9 the average being 3.

But the geometric mean would be 2 x 3 x 4 = 24, and the cube root of 24 is 2.884. So why do the bourgeoisie prefer the geometric mean over the average? Because the geometric mean is never greater than the average and is only ever equal to the average when all the numbers in the data set are equal.

Has your rent ever been the same price as a loaf of bread? So in real life the geometric mean as applied to the CPI has always been less than the average; heads they win , tails you lose.

The geometric mean has been applied to the CPI since 2002. Again, its objective is to understate the real increases in the CPI and thus pay Social Security recipients less!

The upper-level substitution bias

This is when you substitute chicken legs for that rib eye steak. And again the bourgeois economists use flippant examples like buying pears instead of apples. But instead let’s go from the trivial to the grotesque. On February 8, 2024 Chris Hedges wrote an article titled “Let Them Eat Dirt.”

He writes: “More than half a million Palestinians… are starving in Gaza…There are few fruits or vegetables. There is little flour to make bread. Pasta.. meat, cheese and eggs have disappeared. Black market prices for dry goods such as lentils and beans have increased 25 times (that’s 2500 percent) from pre-war prices. A bag of flour on the black market has risen from $8 to $200.” Hedges continues: “The precursor to starvation – undernourishment – already affects most Palestinians in Gaza… In desperation people begin to eat animal fodder, grass, leaves, insects, rodents, even dirt.” This is upper-level substitution at its most extreme. But from the bourgeois economists’ point of view inflation has not gone up by 2500 percent since October because not everyone is eating those expensive lentils because they are eating grass instead. So one takes the number of people eating lentils and the number of people eating those almost free rats and grasses and applies the geometric mean to get a much lower inflation rate!

This way of measuring inflation by “correcting” upper-level substitution bias is dubbed the Chained Consumer Price Index for All Urban Consumers (C-CPI-U). Here chained means comparing what people buy from one month to the next when the price of something goes up and you buy something else, rather than thinking that you’re still buying that expensive rib eye steak or if you’re Palestinian those expensive lentils.

I discuss what’s happening in Gaza to show that in the last analysis, it is not just an arbitrary value judgment between apples and pears or rib eye steak and chicken legs, but a never-ending downward spiral that has lead to people eating grass and rats.

And if anyone needs an example closer to home the Wall Street Journal published an article entitled “It’s Been 30 Years Since Food Ate Up This Much of Your Income.” On February 21 Jesse Newman wrote, “An ad campaign launched in 2022 (by Kellogg) encouraged consumers to eat cereal for dinner” albeit with milk and fruit, with the tagline “Give chicken the night off.” Well just try that if you have small children.

Lower and upper “bias” account for 0.4 percentage points of the supposed bias of the CPI.

Next up is the “New product bias,” where a new product is not incorporated into the CPI’s market basket until it becomes commonly purchased. The Boskin Commission however, thinks that this new product should be incorporated into the basket of the CPI only when a few percent of the population is buying it. They give a few examples from the 1980’s and 90’s making it hard to judge, like personal computers and cell phones. But a present day example would be electric cars. As of 2022 about one percent

of the US population owned an electric car. In the fall of 2023 Tesla, the leading electric car manufacturer, had two major price cuts. While this is good news for the 1 or 2 percent who were going to buy a Tesla this year, for the other 97 percent it’s not. Because those Teslas that you’re not buying are lowering the CPI and therefore your COLA. This seems fair to the bourgeoisie.

Next on the hit parade is the “quality bias.” New cars are a good example. Before 1968 seat belts were optional, therefore buying a car with a seat belt cost more, this being a true quality improvement, thus not raising the CPI. But in 1968 they were made mandatory. At that point the CPI should have gone up because you couldn’t buy a new car without one. The same can be said of air bags (1996) and anti-lock brakes (2012). Adding a sun roof or heated front seats should not count towards the CPI as they are quality improvements. New product and quality “biases” account for about 0.6 percentage points of the CPI’s “bias”.

Next is the “outlet bias,” that is, when Wal-Mart, Sam’s Club or Costco sell things for less than other places. This bias would be legit except for two things. First that mean old geometric mean. And second it doesn’t take into account the high price Whole Foods bias which would raise the CPI. Yes, Whole Foods would raise the CPI all by itself; it’s not called “Whole Pay Check” for nothing.

One of the better examples is the wine at Whole Foods. It’s 10 percent more than the Chicago-based Binny’s Beverage Depot charges for the same bottle, and a lot more than Cosco.

The bourgeoisie was quick to add the outlet bias but has been “thinking” about the Whole Foods bias for more than a decade.

So far we have been talking about small percentages, 0.4, 0.6 and 0.1 percent which only adds up to 1.1 percent. But through the magic of compound interest. it’s been 24 years since the geometric mean was introduced to the CPI.

The Senior Citizens League (SCL) estimates Social Security benefits calculated with the government’s “geometric mean” have lost about 36 percent of their buying power.*

In the year 2000 the average Social Security payout was $816 per month. With the CPI going up 78 percent by February 2023, the average payout is $1452.48. However, the SCL estimates the payout should have been $1969.82 or $517.34 more each month than it is today.

More government manipulation

In 2008 congress mandated an experimental CPI for people 62 years of age and older (CPI-E). Seniors spend more on housing and medical care and less apparel, education and transportation. Net, the CPI-E would be higher than the CPI-W (urban wage earners and clerical workers). To this day Congress is still “thinking” about using the CPI-E for the cost of living adjustment.

Next there’s Medicare Part B premiums, $174.70 per month, usually deducted from your Social Security check. The premiums usually go up every year. Then there’s Medicare supplemental policies (prices vary), deductibles and co-pays. Medicare Advantage is just privatized Medicare that’s not nearly as good as the real thing and should be abolished.

You pay 2.9 percent of your wages for life and then the government charges you $174.70 per month? We need Medicare for all with no premiums, deductions or co-pays.

In 1983 Ronald Reagan got Congress to pass a law to tax 50 percent of an individual’s or couple’s Social Security benefits if they earned more than $25,000 or $32,000 respectfully. Well $25,000 was a lot more in 1983 than in 2024. According to the Bureau of Labor Statistics $25,000 in 1983 is now worth $78,839 and $32,000 is worth $100,914, and of course the CPI understates inflation. So in 1983 the IRS was taxing about 10 percent of households. In 1993 Bill Clinton got Congress to pass a bill taxing up to 85 percent of your Social Security benefits for individuals making $34,000 and couples making $44,000, that’s $73,536 and $95,164 today. The catch is that there is no COLA for these numbers. Just like abortion rights and the federal minimum wage they must have “forgot.”

Cheating workers for decades

We should see a pattern; both the Republicans and Democrats have been cheating the working class for decades, well actually forever, with the only difference being that the Democrats have been able to get away with more. One will note that the Republicans and Democrats can bail out the banks over a weekend

They got their money before the markets opened at 8:30 AM Eastern time or come up with money for genocide in Gaza on short notice and yet when it comes for money for the working class all they ever say is “how will we ever pay for it?”

We need a fighting Labor Party based on qualitatively expanded and democratically organized trade unions in alliance with all the oppressed and exploited. Capitalism’s twin parties, the Democrats and Republicans, can’t be reformed.

• For an immediate increase of $520 per month to the Social Security payout.

• Use the Arithmetic mean and not the Geometric mean to calculate the CPI

• Make Social Security’s payout a living wage.

• Medicare for All with no premiums, co-pays or deductibles.

• Lower the full retirement age to 62 from 67 for Social Security eligibility.

• No State or Federal taxes on Social Security.

* “You’ll Get a Bigger Social Security Check in 2024. Don’t Get Too Excited “ by Christy Bieber, Motley Fool Dec. 23 2023

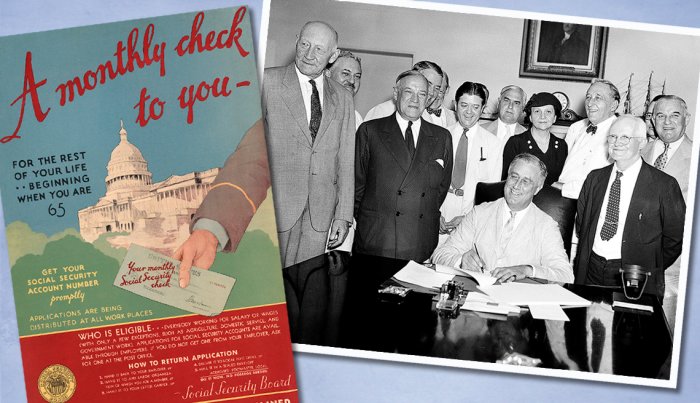

*Featured Image: Aug. 14, 1935: President Franklin Roosevelt signed the Social Security Act into law. PHOTO BY: Archive/GraphicaArtis/Getty

John Pottinger is a member of the Socialist Action National Committee