By Thomas Davies , originally published on Fire This Time, August, 2019

If you’re wondering how surreal environmental politics have been in Canada over the past year, here’s “Exhibit A”: this Halloween, Environment Minister Catherine Mckenna came to Parliament Hill dressed up as a “Climate Crusader” – while at the same time overseeing a Ministry which, according to its audits, won’t even come close to its United Nations climate commitments. Prime Minister Justin Trudeau also somehow found it unironic to dress up as Superman after his campaign slogan “Real Change Now” has become more like “Real Disappointment Now” – especially when it comes to Indigenous rights and climate action.

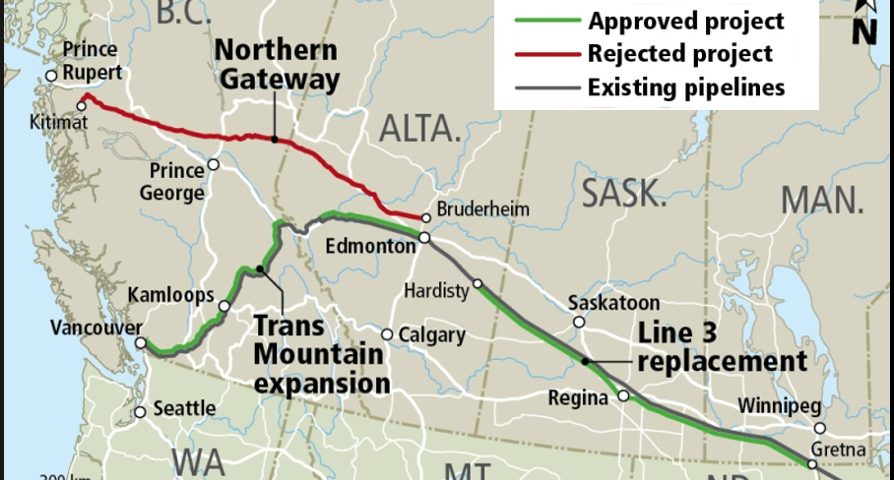

However, Superman and the Climate Crusader took it to a whole other universe this May when they decided to become Oil Company Executives and committed billions of taxpayer dollars to buy the existing Trans Mountain pipeline and its and controversial expansion project from Kinder Morgan.

It was a move that even the most skeptical observer probably didn’t expect, and while protests were immediate and continued, there has been some necessary recalibration and fact-finding as to how this government bailout effects the project and the campaign to stop it. Truth be told, what we are finding out is even worse than we thought possible. It’s hard to summarize the absurdity, but here are 7 Important Facts About the Trudeau Pipeline Bailout:

1 — It’s More Like a $15-20 Billion Commitment Than $4.5 Billion

We reported this last issue, but it’s worth repeating. Well-known economist and specialist on the Trans Mountain pipeline Robyn Allan found that

“By the time the expansion is built, the price tag for nationalizing the existing assets and building the expansion will cost Canadians upwards of $15 – $20 billion.

That’s because the $7.4 billion capital cost for the project estimated in February 2017 will likely exceed $9 billion by the time an up to date budget is prepared. Then there is $2.1 billion in financial assurances required for the land-based spill risk and $1.5 billion Oceans Protection Plan for marine spill risk that Ottawa has already agreed to.”

2 — The Alberta Government Admitted in Its Budget that the Pipeline Won’t Create New Revenue

Another Robyn Allen investigation found that despite claims from the Alberta government that the pipeline expansion would add $15 billion a year in government revenue, their Budget explains it would provide no economic benefit because any potential pricing gain from increased pipeline capacity will be offset by major heavy oil pricing problems.

“In 2016, the International Maritime Organization (IMO) announced new regulations to reduce greenhouse gas emissions. It ruled that after January 1, 2020, marine vessels will be required to burn fuels with a sulphur content of no more than 0.5 percent, reducing the current sulphur content cap by 3 percent.

Alberta’s Budget clearly states that ‘the light-heavy differential is forecast to remain wide as new rules on the sulphur content of marine fuels from the International Maritime Organization go into effect. This is expected to reduce demand for bunker fuel, which mainly comes from heavy oil, and reduce heavy oil prices.’

Alberta’s Budget identifies that the price impact of IMO 2020 will be about $8 US per barrel. What this means is that instead of the promised narrowing of differentials from Trans Mountain’s expansion, Alberta expects none.”

3 — This is Going to Cost Taxpayers Big Time

A new study released by the Institute for Energy Economics and Financial Analysis (IEEFA) said buying the Kinder Morgan Canada assets, plus planning and construction costs will put $6.5 billion in unplanned spending on the books for the 2018-19 fiscal year. This will add 36% to the already projected $18.1 billion deficit. Some of the report’s key points:

“There is every indication that the Canadian government has bought the pipeline at a high price and is likely to resell it for far less than it will pay to build it.

“The Canadian government is taking open-ended responsibility to absorb all costs and ensure profits for any potential new owner of the pipeline. As a result, long-term cost increases for taxpayers are effectively uncapped, posing a significant, unquantifiable liability.”

4 — Kinder Morgan is Making Out with a 637% Profit

The same report also found that:

“IEEFA estimates that the outlay that can be attributed to Kinder Morgan Inc. for the project is approximately $610 million. Between them, Kinder Morgan Inc. and Kinder Morgan Canada will receive $3.89 billion in profit. This amounts to a return on an outlay of 637%.”

Two Kinder Morgan Canada Executives, Ian Anderson and David Safari, will also earn $1.5 million each in bonuses from the sale.

5 — They Call Us ‘Fanatics’ While Issuing Death Threats

David Dodge, former Bank of Canada governor and high-profile advisor to Alberta’s NDP government, recently made this threatening prediction at a public talk in Edmonton,

“There are some people that are going to die in protesting construction of this pipeline. We have to understand that. Nevertheless, we have to be willing to enforce the law.”

He then went on to say, “It’s going to take some fortitude to stand up [to them],” while referring to those who oppose the pipeline as “fanatics” who have “the equivalent of religious zeal.”

So who are the “fanatics” and why didn’t Trudeau or Notley publicly condemn these not so subtle threats?

6 — There are Still Many Potential Hurdles Before Construction

A recent press release by the West Coast Environmental Law points out,

“the federal government, as the owner of the pipeline, must honour its commitment to the NEB process, including the 157 conditions, to ensure the project’s safety. These conditions include obtaining more than 1,000 permits required for the construction and approving a safe, final route through multiple route hearings. There are also around 40 pre-construction conditions still under review, including a dozen that applies to the Burnaby terminal, which is slated for construction in a week.”

It continues,

“The NEB conditions are weak, ignoring concerns made by First Nations and science on bitumen spills. However, at a minimum, whoever owns the pipeline must at least honour what is there.”

There are also currently 14 legal challenges before the Federal Court of Appeals.

7 — We are the Most Important Factor

While permit applications and legal challenges have been able to slow projects down, it’s rare they stop them. With literally billions of dollars at stake, there’s always a loophole found or a convenient excuse for why the rules were changed at the last minute. The reason the project is so far behind schedule and the government is resorting to such desperate measures is ongoing mass public opposition. Without it, the pipeline would already be built.

This has been a successful formula so far, but we need to go even further the get the project cancelled. This means continuing to mobilize the hundreds of thousands already opposed, and appealing to the many more who are disgusted by this huge waste of taxpayer money and confused about the alternatives. We have a real opportunity here – let’s make the most of it!

No Trudeau Pipeline Bailout!

People and Planet Before Pipelines and Profits!

Follow Thomas Davies on Twitter: @thomasdavies59