by Lauren Smith, published on MROnline, March 10, 2020

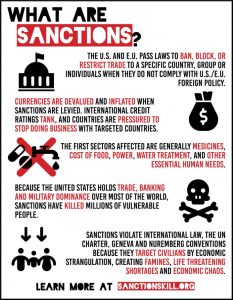

Since the start of the great recession in 2008 the U.S. has become increasingly dependent on the use of unilateral economic sanctions to achieve its policy objectives against its declared targets. Presently, sanctions impact one-third of humanity in 39 countries. Economic sanctions not only cause untold death and devastation to a given country by denying it access to U.S.-dominated markets—which restricts its ability to generate wealth, stabilize its currency against price fluctuations and provide critical services and resources for its people—but economic sanctions also serve to justify and conceal theft, through asset freezes and seizures, at a rate only previously accomplished through invasion and occupation.

As the justification for applying economic sanctions becomes increasingly nebulous and contradictory, and more U.S. governmental entities are granted sanction making authority through a maze of acts, executive orders, and laws—rendering the navigation and analysis of economic sanctions complex at best—it becomes increasingly important to not only uncover the victims of economic sanctions but also the victors. Additionally, it is necessary to understand how economic sanctions are used to prop up an unsustainable financial house of cards through the repurchasing (repo) market, and how sanctions are critical to buttress troubled industry by engendering monopoly capitalism—via the selective approval of sanction waivers/licenses.

As the justification for applying economic sanctions becomes increasingly nebulous and contradictory, and more U.S. governmental entities are granted sanction making authority through a maze of acts, executive orders, and laws—rendering the navigation and analysis of economic sanctions complex at best—it becomes increasingly important to not only uncover the victims of economic sanctions but also the victors. Additionally, it is necessary to understand how economic sanctions are used to prop up an unsustainable financial house of cards through the repurchasing (repo) market, and how sanctions are critical to buttress troubled industry by engendering monopoly capitalism—via the selective approval of sanction waivers/licenses.

It is also important to note that this massive ongoing bailout does not serve U.S. businesses or its working-class, as profits are extracted and concentrated into the hands of oligarchs and are thereby not reinvested productively into the national or global economy. Inflated prices for imported commodities and raw materials, and the loss of once prospering export markets, remain in the wake of sanctions. In its entirety, U.S. economic sanctions can only be understood as a street corner shell game leading up to the big heist.

Victims and victors

The victims of economic sanctions are easy to identify because they are visible—there are dead bodies and malnourished children, with stunted growth and development, in once-thriving communities. They constitute the underemployed and working-class and are predominately people of color.

Whereas the victors are concealed. They hide behind banks, leveraged financial institutions (hedge funds) and major industry through their controlling interest. They constitute the capitalist class and are white. Within this context, economic sanctions are shown as class and race warfare cleverly and conveniently disguised as a “more friendly” way to “make the world safe for democracy.”

But, it isn’t bad enough that economic sanctions are a means to sanctify robbery and are a precursor of financial doom, their gory horror rests in them being an incidental mode of genocide through lethal selection—which operates through the destruction of the individual by some adverse feature of the environment, such as excessive cold, or bacteria, or by bodily deficiency.

Note that the U.S. white ruling elite has a history of funding eugenics research/experimentation, installing and empowering fascist dictatorships, and is particularly interested in “population control”—when it involves people of color.

Impact of sanctions

As applied, economic sanctions function as undeclared war by creating severe economic disruption and hyperinflation in many countries—effects that can be illustrated by the grave economic upheavals experienced by Venezuela, Iraq, Iran, and Cuba. In Cuba’s 2019 report, it is explained that the U.S. economic blockade has deprived it of $922.6 billion (adjusted for inflation) over nearly six decades.

Further, because economic sanctions interfere with the functioning of essential infrastructure i.e. electrical grids, water treatment and distribution facilities, transportation hubs, and communication networks by blocking access to key industrial inputs, such as fuel, raw materials, and replacement parts, they lead to droughts, famines, disease, and abject poverty, which results in the death of millions.

Exact numbers are difficult to quantify because no international tally of casualties related to economic sanctions is recorded, which obfuscates its overall fatal impact. According to the Center for Economic and Policy Research’s 2019 report, 40,000 people have died in Venezuela since 2017 due to U.S. sanctions. According to a new report, sanctions against North Korea found that 3,968 North Koreans died due to sanctions-related delays and funding deficits in 2018, including 3,193 children under the age of 5 and 72 pregnant women. A report on Iraq from 1995 attributes the death of 576,000 children to U.S. sanctions. Further, sanctions weaken a targeted country’s ability to handle natural and climate change disasters. For example, Haiti was subject to sanctions from 1992-1996 and simultaneously suffered Hurricane Gordon in 1994, which resulted in 2,000 deaths and disappearances in addition to the deaths of thousands of children directly caused by U.S. sanctions. In the case of Lebanon, food, clothing, and medicine intended to be used to relieve human suffering were specifically blocked. As shown by Iran with the COVID-19 epidemic, banking sanctions have delayed Iran from importing test kits.

Exact numbers are difficult to quantify because no international tally of casualties related to economic sanctions is recorded, which obfuscates its overall fatal impact. According to the Center for Economic and Policy Research’s 2019 report, 40,000 people have died in Venezuela since 2017 due to U.S. sanctions. According to a new report, sanctions against North Korea found that 3,968 North Koreans died due to sanctions-related delays and funding deficits in 2018, including 3,193 children under the age of 5 and 72 pregnant women. A report on Iraq from 1995 attributes the death of 576,000 children to U.S. sanctions. Further, sanctions weaken a targeted country’s ability to handle natural and climate change disasters. For example, Haiti was subject to sanctions from 1992-1996 and simultaneously suffered Hurricane Gordon in 1994, which resulted in 2,000 deaths and disappearances in addition to the deaths of thousands of children directly caused by U.S. sanctions. In the case of Lebanon, food, clothing, and medicine intended to be used to relieve human suffering were specifically blocked. As shown by Iran with the COVID-19 epidemic, banking sanctions have delayed Iran from importing test kits.

“Several international companies are ready to ship the coronavirus diagnosis kit to Iran, but we cannot pay them, said Ramin Fallah, vice president of the Iranian Union of Importers of Medical Equipment.”

This delay may have contributed to 34 deaths and over 388 new cases. According to statistical models the epidemic may impact 18,000 Iranians.

Overall, economic sanctions deny hospitals and health care facilities essential supplies needed to initiate lifesaving procedures and operate machinery and equipment. Additionally, economic sanctions undermine progressive social programs that improve health, nutrition, and education in Nicaragua, Venezuela, Cuba, and Zimbabwe amongst other countries. Within this context, the victims of economic sanctions aren’t the white ruling elite, that can travel at will and pay inflated prices for commodities, but the indigenous people of color without sufficient means or resources due to the historic underdevelopment inherited from colonialism and prior installations of U.S. puppet regimes.

Economic sanctions violate international and humanitarian law

Economic sanctions violate international law and the fundamental principles that govern diplomacy and multilateralism under Chapter VII of the United Nations Charter. Further, they circumvent human rights obligations and international humanitarian law set forth in the Fourth Geneva Convention, the Genocide Convention, Nuremberg Charter, Constitution of the World Health Organization, and in the Universal Declaration of Human Rights, and Rome Statute of the International Criminal Court. Additionally, since economic sanctions violate international law, they are thereby in violation of domestic law pursuant to the Supremacy Clause of the U.S. Constitution and U.S. Supreme Court’s decisions holding that “international law is our law.”

List of countries under economic sanctions

This list below was complied from original research because the U.S. Department of the Treasury’s Office of Foreign Assets Control (OFAC)—the entity that promulgates, develops and administers the laws used to impose economic sanctions against its targets—does not provide a comprehensive list.

- Afghanistan

- Belarus

- Bosnia and Herzegovina

- Burundi

- Central African Republic

- China (PRC)

- Comoros

- Crimea Region of Russia2

- Cuba

- The Turkish Republic of Northern Cyprus

- Democratic Republic of the Congo

- Guinea

- Guinea Bissau

- Haiti

- Iran

- Iraq

- Kyrgyzstan

- Laos

- Lebanon

- Libya

- Mali

- Mauritania

- Moldova

- Montenegro

- Myanmar

- Nicaragua

- North Korea (DPRK)

- Palestinian Territories

- Russia

- Rwanda

- Serbia

- Somalia

- South Sudan

- Sudan

- Syria

- Tunisia

- Venezuela

- Yemen

- Zimbabwe

Expansion of sanctions

Approximately 6,300 entities and individuals are on OFAC’s Specially Designated Nationals and Blocked Persons List (an “SDN List“). Since these entities can reside anywhere globally, even more countries than what is listed above may be indirectly sanctioned—especially if the given targets hold leadership roles in government or key industries. Entities that an SDN owns (defined as a direct or indirect ownership interest of 50 percent or more) are also blocked, regardless of whether that entity is separately named on the SDN List.

Aggregate data that would be useful for comparison to earlier years is absent from OFAC’s website, as is a comprehensive list of sanctioned countries as mentioned above. However, growth in civil penalties is reported in aggregate and shows that sanctions violations skyrocketed to $1.3 billion in 2019 from $3.5 million in 2008. Additionally, besides the president and congress, state and local governments and thirteen U.S. agencies and offices now have sanction making authority.

The proliferation of sanctions cases over the past two decades has also sparked academic debate over their effectiveness as a foreign policy tool. In terms of changing behavior, sanctions are considered to have a poor track record, with a modest 20-30 percent success rate at best.

Extraterritorial sanctions

Extraterritorial sanctions are proliferating too. They apply to persons in countries not otherwise subject to sanctions. For example, while the 2012 Magnitsky Act was originally set against Russia, it has been repurposed to apply to any foreign national deemed responsible for or complicit in “human rights violations” or “corruption.” U.S. captive quasi non-governmental organizations and associations such as the National Endowment for Democracy (NED), Organization of American States (OAS), Amnesty International, Human Rights Watch and religious organizations, etc. are notorious for assembling and proselytizing baseless cases against leaders that Washington targets for regime change, while ignoring the flagrant human rights abuses of military dictatorships and coups that allow the United States unfettered access to their natural resources.

Examples of frozen and seized assets

The Russian Foreign Minister, Sergey Lavrov, claims that the U.S. simply confiscates Venezuela’s money under the guise of sanctions, noting that the U.S. is experienced in such illegal affairs, giving Iraq, Libya, Iran, Cuba, Nicaragua, and Panama as examples. As can be shown below, these economic sanctions involve sizable assets. Note that the concept of “frozen” assets only applies to the sanctioned entity’s access. The sanctioned capital is worked by banks and hedge funds. The following examples are illustrative but not exhaustive—as it is nearly impossible to find information on frozen foreign assets in publicly released government reports, except for the OFAC Terrorist Asset Report that shows in aggregate in 2018 that Iran, Syria and North Korea had $216 million in blocked funds by the OFAC. In the news media, the listing of frozen assets is either aged or incomplete.

VENEZUELA

In August 2019, Venezuela’s foreign minister, Jorge Arreaza, stated that the sanctions the United States imposed against it had left more than $3 billion of its assets frozen in the global financial system. Additionally, The Bank of England blocked Venezuela’s attempts to retrieve $1.2 billion worth of gold stored as the nation’s foreign reserves in Britain. It is reported that former national security advisor to President Donald Trump, John Bolton, pressured England to freeze Venezuelan assets. By some estimates, Venezuela holds more than $8 billion in foreign reserves. Additionally, the U.S. froze all the assets Venezuela’s state-owned oil company, PDVSA, has in the United States. While it allows PDVSA’s U.S.-based subsidiary, Citgo, to operate, it confiscates the money it earns and places it in a blocked account.

IRAN

Many still question what happened to an estimated $100-120 billion in frozen Iranian assets which were reportedly being held by banks and institutions around the world in 2015. To give some perspective on future value, consider that in interest alone, without including the opportunity cost of not being able to invest the funds productively in the Iranian economy or inflation, $400 million in Iran’s frozen assets that date back to the overthrow of the shah theoretically yield $10 billion—taking into account the high rate of interest in the 1970s.

IRAQ

In 2003, President Bush signed an order to take possession of the Iraqi government assets that were frozen in 1990, before the Persian Gulf War. As a result, seventeen of the world’s biggest financial institutions were told by the Treasury Department to hand over $1.7 billion in frozen Iraqi assets that the U.S. government intended to place in an account at the NY Fed.

KUWAIT

In 1990, President Bush froze $30 billion in Iraqi and Kuwaiti assets in the United States to deny Kuwait’s government access to the foreign petrodollar investments, valued at close to $100 billion.

LIBYA

In 2015, it was announced that $67 billion in Libya’s assets remained frozen from 2011. In 2018, it was announced that Libya’s assets had decreased to $34 billion. The UN Libya Experts Panel is “looking for answers” to explain the disappearance of $33 billion in frozen assets.

Federal Reserve Bank of New York

To unearth the beneficiaries of U.S. economic sanctions, its necessary to follow the money. Here, the trail leads to the Federal Reserve Bank of New York (NY Fed). The NY Fed is the bank the United States government uses to administer approximately 250 foreign government accounts, according to its 2015 promotional material. A list detailing the countries and the value of their accounts is not available to the public. This is not an oversight by the Federal Reserve. At present, even the U.S. General Accounting Office (GAO) is prohibited by law from auditing the Federal Reserve’s transactions for or with foreign central banks, the governments of foreign countries, and private international financing organizations. S. 148: Federal Reserve Transparency Act of 2019 was proposed to correct this issue.

Foreign governments use the NY Fed to receive and make payments in U.S. dollars, for investing in and holding U.S. dollar-denominated debt securities, and for executing transactions in the foreign exchange market for the purchase and sale of non-dollar currencies. Most of the assets in foreign official accounts at the New York Fed are in the form of marketable U.S. government securities and securities of government-sponsored enterprises (federal agencies). The NY Fed is part of the federal reserve system which consists of 12 banks administered by a Board of Governors and is directly accountable to Congress.

Within this context, the NY Fed serves as the non-black-market conduit for the transfer of wealth from targeted countries and entities into the coffers of select U.S. banks and hedge funds through the repo market, which functions as a $1-trillion-a-day credit machine. Essentially its assets, which include ill-gotten foreign funds, end up as risk-free low-interest loans to its “dealers” in a stopgap measure to offset the large amount of debt instruments issued by the Treasury Department. As the growing federal deficit tops one trillion dollars, and the consumer debt exceeds 14 trillion—extreme pressure is put on the NY Fed to keep interest rates artificially low in the short and medium-term via Quantitative Easing (QE) and repo agreements.

While the NY Fed maintains $3.3 trillion in foreign assets, seized and frozen foreign accounts are not flagged by either the NY Fed or by OFAC (except for terrorist asset funds as detailed above). This unconscionable omission shields sanctions booty from scrutiny by U.S. elected officials and taxpayers, as well as journalists.

However, The NY Fed’s Independent Auditors’ Report for Years Ended December 31, 2018, and 2017, does explain that reverse repurchase agreements may also be executed with foreign official and international account holders as part of a service offering. Also, the Federal Reserve Statistical Release H.4.,1 dated February 27, 2020, notes on line item titled “Reverse Repos” that it totals $221 billion, and that line item titled “Foreign Official and International Accounts” plus “Others” is equivalent to “Reverse Repos.”

To better understand how precarious the U.S. economy is due to profiteering by the NY Fed’s dealers, consider that they take between $20 to $30 billion in net assets (see table 1A. Memorandum Items, Securities lent to dealers) under management and leverage it up to $200 billion. In 2017, the top 25 U.S. banks were reported to have $222 trillion of exposure to repos/derivatives. When understanding that this level of exposure is approximately equivalent to the Gross Domestic Product (GDP) of the United States times twelve, it is clear that the U.S.’s artificial dependence on repos undermines its economy, and that literally all the theft in the world is not enough to stave off the U.S.’s impending systemic collapse.

Another method used by the Treasury to redistribute and concentrate wealth is through the granting of exclusive monopoly style sanctions waivers/licenses in a veiled process that benefits select corporations and individuals. Through this method, the U.S. can target entire industrial sectors within countries such as the oil, pharmaceutical and agricultural industries to decimate them and force dependence on the products/services of elite U.S. corporations. Lastly, through sanctions waivers/licenses it can reward countries favorable to U.S. corporations by eliminating its global competition. Note how sanctions against Venezuela and Iran increase Saudi Arabia’s oil industry market share. Due to sanctions on Iran, Saudi Arabia overtook Russia to become China’s top oil supplier.

Also, contrived scarcity conditions serve to inflate price without increasing cost as is also in the case of aluminum. Note how sanctions reward dealers’ access to repos by interfering with the repatriation of wealth. Through delays to crucial cash deliveries and slashed sanctions waivers, Iraq’s Central Bank must fly in $1-$2 billion in cash almost monthly from the NY Fed, where all its oil revenues are kept, to pay for official and commercial transactions. Oil accounts for 90 percent of Iraq’s state revenue.

Impact of sanctions on the U.S. economy

Sanctions cost businesses in the U.S. billions of dollars a year in lost sales and returns on investment; and by extension sanctions also cost many thousands of workers their jobs. Exports lost today may mean lower exports even after sanctions are lifted because U.S. firms will not be able to supply replacement parts or related technologies. Foreign firms may also design U.S. intermediate goods and technology out of their final products for fear of one day being caught up in a U.S. sanction episode.

As a consequence of U.S. sanctions, workers probably lost somewhere between $800 million and $1 billion in export sector wage premiums in 1995. Using this formula, the cumulative loss of wage premiums may exceed $25 billion (25 years times roughly $1 billion a year, not taking into account inflation, the rising annual loss of exports or the exponential increase of sanctions by 2020). However, these costs are routinely overlooked or underestimated because they are not factored into any U.S. government budget table.

Within this context, the proliferation of economic sanctions can be added to the list of indicators that reveal the failing health of the U.S. economy, as plunder through economic sanctions, not productivity, is instrumental in keeping the impending “repo crisis” at bay. Since the 2008 great recession, it can be argued convincingly that the capitalist system is in its death throes.

Justification for economic sanctions

While unilateral coercive economic sanctions are transactional constraints imposed by the U.S. against countries, groups, entities, and individuals that resist its dictates, neoliberal policies, and regime change efforts, Washington instead markets economic sanctions to the gullible as a “smart” and “more peaceful” way to combat the proliferation of weapons of mass destruction, terrorism, money laundering, and drug, weapon and human trafficking. However, these lies are sometimes too difficult for even Washington to manufacture and maintain through its captive news media, as the United States criminal leadership in these illicit activities often gets exposed.

Not only did the U.S. 1981 coup attempt in Nicaragua fail, just as it did again in 2018, but it revealed the drug, weapon and human trafficking operations routinely undertaken by Washington’s intelligence agencies to the public and members of congress and the senate. And, the opium trade has never been better in Afghanistan since the U.S. invasion and occupation. Afghanistan now produces 80 percent of the world’s opium supply and U.S. troops are spotted protecting poppy fields.

As such, economic sanctions are also slyly marketed by Washington, as being a means to forward its speciously defined “humanitarian” and “democratic” agenda. This sets a much lower bar with an even more subjective and easier to fake criteria; and allows the United States to implement, with impunity, economic sanctions that devastate the most vulnerable people in the countries it hypocritically claims it is seeking to protect.

Consider that Nicaragua, a tiny peaceful country the size of New York state, shares no border with the U.S. superpower; has no weapons of mass destruction; has no trafficking (unlike its neighboring countries); has no terrorist cells; and was lauded by the IMF and World Bank in their 2018 reports, was nonetheless called by U.S. President Donald Trump in 2019 “a threat to the national security and foreign policy of the United States.” This bold-faced lie of Trump’s serves to justify the grave misuse of executive privilege granted under the International Emergency Economic Powers Act (50 U.S.C. 1701-1706) and clearly exemplifies how economic sanctions are a charade and an economic weapon used purely for regime change.

The branding of a target with a terrorist label enables an even faster method of appropriation. So far in 2020, the State Department lists 69 entities as terrorist organizations. Because it includes the Islamic Revolutionary Guard Corps (IRGC) on its list, Washington justifies sanctions being waged even against Iranian banks under Executive Order 13324.

On paper, the State Department’s Bureau of Counterterrorism identifies potential targets for designation, not the CIA. But not only does it consider actual terrorist attacks that a group has carried out for this sanctionable classification, but also if a group has the “capability and intent to carry out such acts.” Thus, an entity can be sanctioned for thought crimes projected upon it by the United States government. In effect, only the United States and its select allies can “safely” have a functional military with weapons of mass destruction and remain in a position to defend themselves. Further, a “terrorist activity” or “terrorism” is not only defined as an imagined threat to the “national defense” of the United States but also an imagined threat to its “foreign relations and economic interests.” Often sanctions are set specifically to disrupt the trade relations of geopolitical foes like China and Russia—as evidenced by the case of Zimbabwe, a country with an abundance of strategic raw minerals.

Secondary sanctions

But it is not unilateral sanctions imposed by the U.S. alone that devastate a targeted country, it is the imposition of secondary sanctions upon foreign third parties that represents the final blow to its economy and people. These measures threaten to cut off foreign countries, governments, companies, financial institutions and individuals from the U.S. financial system if they engage in prohibited transactions with a sanctioned target—irrespective as to whether or not that activity impacts the United States directly.

This forces all parties worldwide to comply with U.S. dictates or risk financial penalties, criminal charges, and sanctions. This has a chilling effect on the world economy for even allied developed nations are reluctant to cross Washington to trade with sanctioned countries, as corporations and banks not on Washington’s inside track suffer harsh penalties. Presently, any entity that violates U.S. unilateral sanctions risks severe penalties that range from up to $5 million for individuals, $10 million for corporations, and up to 30 years imprisonment. With over 1,000 military bases and installations in over 120 countries, U.S. aggression remains an ever-present threat against noncompliance as well.

In 2019, Standard Chartered PLC and Standard Chartered Bank, of London, England, were issued penalties totaling $1.1 billion for “inadequate sanctions controls and failure to disclose sanctions risks to the Federal Reserve.” Within the last decade, New York’s Manhattan district attorney reportedly received $4.6 billion in penalties due to a dozen large criminal cases against major foreign banks for alleged violations of U.S. economic sanctions and New York state law. Penalties accrued in the past two years (2018–2019) alone account for 17 percent of the total. The largest case involved a joint investigation with multiple federal and state authorities against BNP Paribas SA, a French bank, for violating U.S. sanctions by processing transactions for blacklisted clients.

Conclusion

When analysis is done to uncover the big winners of U.S. economic sanctions it is learned that ExxonMobil and JP Morgan Chase Bank are often front and center; case in point, Iran, Iraq, and Venezuela. Also, consider that JP Morgan Chase Bank did very well in the 2008 collapse through vulture capitalism.

Fortunately, U.S. economic sanctions contain the seeds of their own undoing, since they engender the expansion of foreign reserve currencies at the expense of the U.S. dollar, and the phasing out of the U.S. money transfer system (SWIFT) to alternate foreign models such as Russia’s System for Transfer of Financial Messages (SPFS).

But since millions of lives are at stake now, it is imperative that secondary sanctioned countries, business owners, workers, and elected officials join together with sanctioned countries and peace activists to end economic sanctions. The oligarchy must be stopped from literally stealing the wealth of the world.

Lauren Smith is an independent journalist. Her work has been published by Counterpunch, Common Dreams, Telesur, Monthly Review, Alliance for Global Justice and Global Research, CA amongst others. She holds a BA in Politics, Economics and Society from SUNY at Old Westbury and an MPA in International Development Administration from New York University. Her historical fiction novel based on Nicaragua’s 1979 revolution is due out this year.

Footnotes:

- Factual correction by the UNAC Editor: Crimea is a part of Russia. They people of Crimea voted to leave Ukraine and join with Russia following the fascist coup in 2014. Russia accepted them. Prior to the breakup of the Soviet Union, Crimea was a part or Russia until Nikita Krushchev transferred it to Ukraine in 1954. His action was a political expedience which was contested by Russia at the time. It surely had not occurred to him that Ukraine and Russia, both members of the Soviet Union, would one day be separated by the breakup of the Soviet Union.

- Factual correction by the UNAC Editor: Crimea is a part of Russia. They people of Crimea voted to leave Ukraine and join with Russia following the fascist coup in 2014. Russia accepted them. Prior to the breakup of the Soviet Union, Crimea was a part or Russia until Nikita Krushchev transferred it to Ukraine in 1954. His action was a political expedience which was contested by Russia at the time. It surely had not occurred to him that Ukraine and Russia, both members of the Soviet Union, would one day be separated by the breakup of the Soviet Union.

Thank you for pointing out the factual error in this article. I have corrected it. Crimea certainly is not a part of the Ukraine at this time. The people of Crimea voted to join with Russia following the fascist coup in Ukraine in 2014. Russia accepted their request and Crimea has been rejoined with Russia since that time.

Crimea was only transferred to Ukraine in the 50s due to some political maneuvering on the part of Nikita Krushchev WITHIN the Soviet Union.